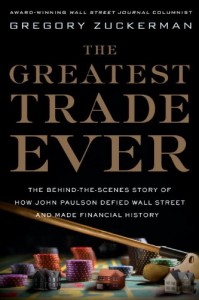

The Greatest Trade Ever: The Behind-the-Scenes Story of How John Paulson Defied Wall Street and Made Financial History. by Gregory Zuckerman. New York: Broadway Books, 2009. 304 pp. $26.00 (hardcover).

The story of lost fortunes and foreclosed homes in the most recent financial crisis is well known. Less known is the story Gregory Zuckerman tells in The Greatest Trade Ever: The Behind-the-Scenes Story of How John Paulson Defied Wall Street and Made Financial History. The book recounts how, prior to the economic collapse, Paulson and a handful of other investors recognized that certain financial assets were dramatically mispriced and adjusted their investments accordingly.

Paulson, the main focus of the book, placed a concentrated bet against risky mortgages that would become the “biggest financial coup in history, the greatest trade ever recorded” (p. 1). Zuckerman provides just enough of Paulson’s background to give readers a sense of who he is and how he got to be where he was in 2001, when the central story began. Zuckerman tells of Paulson breaking apart a pack of Charms candies and selling them to his kindergarten classmates for a profit (p. 17); earning huge commissions on sales of flooring from Ecuador while on a break from university (p. 21); learning to spot investments that “had limited risk but held the promise of a potential fortune” (p. 30); making an investment in a start-up brewery that would produce the Samuel Adams brand and earn him several million dollars (p. 30); giving up the parties that had distracted him for years in order to focus on managing his own hedge fund (p. 32); and marrying the woman he loves (p. 38).

By 2001, “Paulson was on . . . solid footing in his personal life. And his fund had grown as well. He managed over $200 million and had refined his investment approach.” Wall Street still did not think much of Paulson, however. “He wasn’t on anyone’s radar screen,” says one of Paulson’s friends. “But something remarkable was about to happen to the nation and to the financial markets,” writes Zuckerman, “an upheaval that would change the course of financial history and transform John Paulson from a bit player into the biggest star in the game” (p. 38).

Zuckerman relays the essential sequence of events: “The key federal-funds rate, a short-term interest rate that influences terms on everything from auto and student loans to credit-card and home-mortgage loans, would hit 1 percent by the middle of 2003, down from 6.5 percent at the start of 2001” (p. 39). This led to a surge in home sales and, consequently, in home prices. “As home prices surged, banks and mortgage-finance companies . . . felt comfortable dropping their standards, lending more money on easier terms to higher-risk borrowers” (p. 41). Speculative homebuyers, eager to profit from rising prices, “often asked for loans much larger than they could afford” (p. 49). Politicians “pushing for wider home ownership” egged on Fannie Mae and Freddie Mac to step up their purchases of such mortgages (p. 46). Ratings agencies “blessed the pools of loans with top ratings” while being paid well for it (p. 48). And banks such as Lehman Brothers “were eager to buy as many mortgages as they could get their hands on” in order to create new investments for sale to leveraged investors worldwide (p. 46).

While this was happening, writes Zuckerman, Paulson was becoming more and more confident in his investing skills, and this was reflected in the ever-increasing concentration of his investments (p. 54). His fund was also growing, such that by 2004 he was managing $1.5 billion (p. 55).

According to others on Wall Street, however, “[his] style of investing, featuring long hours devoted to intensive research, seemed outmoded,” and his “tried-and-true methods were viewed as quaint” (p. 5). Like Paulson, the other investors in Zuckerman’s story carefully looked at the facts for themselves—neither relying on others’ conclusions nor banking on models they did not understand—and they too were regarded by their peers as odd men out.

For instance, Gregory Lippmann, a senior trader at Deutsche Bank, who did “his own research to make sure the bullish crowd had it right when it came to the real estate market,” realized that if “home prices ever leveled off, defaults would shoot up” (pp. 100–101). Judging that insurance on pools of such mortgages was being sold absurdly cheap—and would soon be in high demand—Lippmann decided to start buying. This was the beginning of the greatest trade ever (the same one that Paulson would soon make in a much bigger way). The trade was not without risk. As with any investment in insurance, there was the chance that the demand for the insurance would not materialize and thus the investment would not pay out. But according to his judgment, the risk was worth taking. “If I’m right,” Lippmann told a coworker, “I’ll make a billion dollars for the bank and it will offset losses elsewhere; if I’m wrong, it’s going to cost twenty million a year” (p. 102). Betting against the housing market—especially by buying insurance that has a guaranteed cost but possibly never pays out—seemed crazy to most on Wall Street, who did not see the value of protecting from losses on housing, an event that had not happened for twenty years. According to Zuckerman, Lippmann became “an object of derision” to many at his own bank (p. 170), who would tell him that “if problems arose . . . the government likely would step in to bail out troubled borrowers” (p. 167).

Paulson himself heard many such arguments—as his investments and risks dwarfed Lippmann’s. Paulson soon held insurance “on $25 billion of subprime mortgages” (p. 196). Zuckerman recounts an expert from Goldman Sachs telling Paulson that his investment strategy was completely wrong. This, according to Zuckerman, left some of Paulson’s staff shaken. He’s an “expert on the market,” one said. Shouldn’t we “change [our] stance?” But Paulson was unmoved. “Keep buying,” he said. After another expert—a preeminent mortgage trader—said that he was not alarmed about housing, a prospective investor in Paulson’s fund asked: “John, why do you think you know more than [him]?” “I don’t care if he’s a mortgage genius,” Paulson responded. “Listen to the logic of my argument” (p. 126). When yet another expert, this one from Bear Stearns, chided him, claiming that Paulson’s team needed “to do more research on historical price appreciation,” Paulson countered: “What are your models based on? The market has changed—now you can get a loan without any documentation. Are you including that in your models?” “Our models are fine,” the expert responded. “We’ve been doing this for twenty years” (pp. 154–55).

The models were not fine. They were, as Paulson and the others in Zuckerman’s story knew, worthless—like the pools of mortgages these men were presciently betting against. “By the fall of 2007,” writes Zuckerman, “the dominoes were beginning to topple.” As the housing market collapsed, and the banks realized the need for insurance to protect them from devastating losses, the value of the insurance skyrocketed—and the investors began to see profits (p. 241). Big profits. Lippmann, whose team “made close to $2 billion in profits” for the bank, earned a $50 million bonus (pp. 248–49). Some of the others earned even more. And Paulson?

Paulson’s winnings were so enormous they seemed unreal, even cartoonish. His firm, Paulson & Co., made $15 billion in 2007. . . . Paulson’s personal cut was nearly $4 billion, or more than $10 million a day. . . . Just as impressive, Paulson managed to transform his trade in 2008 and early 2009 in dramatic form, scoring $5 billion more for his firm and clients, as well as $2 billion for himself. The moves put Paulson and his remarkable trade alongside Warren Buffett, George Soros, Bernard Baruch, and Jesse Livermore in Wall Street’s pantheon of traders. They also made him one of the richest people in the world (p. 2).

The Greatest Trade Ever is a fast-paced and dramatic story of independent thinkers who demonstrate a beautiful truth: There is “a certain virtue in being alone” when one stands with the facts (p. 113). It pays.

![[TEST] The Objective Standard](https://test.theobjectivestandard.com/wp-content/uploads/2017/10/logo.png)