For most of human history, the vast majority of people lived in squalor and bitter poverty. People labored hard in grueling conditions but produced little wealth for their efforts; food was scarce; disease was rampant; child mortality was about 50 percent; and life expectancy was twenty to thirty years. To borrow from Thomas Hobbes, life was “nasty, brutish, and short.”

Today, by contrast, in developed countries such as Britain and the United States, the relatively few people who are considered “poor” typically work in comfortable jobs (if they work at all); have refrigerators, electric light, indoor plumbing, televisions, telephones, and the like; and can expect to live into their seventies. Their “poverty” appears rather fortunate compared to the wealth of kings past. The average person today works in even greater comfort; has a car, a computer, a cell phone, countless other devices of luxury, and a lifestyle that would make any king living in the pre-industrial era look like a peasant.

The dramatic transformation from universal poverty to widespread wealth began in the late 18th century with the Industrial Revolution, which originated in Britain. The Industrial Revolution was just that: a revolution of industry—a revolution in which an enormous increase in the commercial production and sale of goods changed the world and improved man’s standard of living by orders of magnitude. As historian Eric Hobsbawm remarks, “No change in human life since the invention of agriculture, metallurgy and towns in the New Stone Age has been so profound as the coming of industrialization.”1

To see what caused this dramatic transformation, let us look first at the political climate and living conditions of the medieval era that preceded the British Industrial Revolution; then we will consider the politico-economic system in which the Revolution occurred, several related developments that illustrate the nature of the era, and the economic growth that these developments brought about.

Prior to the Industrial Revolution, the standard of living was not merely low; it was abysmally low. Throughout medieval Europe and Britain, unsanitary conditions—contaminated water, spoiled food, infrequent bathing, and the like—often led to infectious diseases and epidemics, such as bubonic plague, smallpox, typhus, and scarlet fever. Insufficient food, diseased livestock, and crop failures led to recurring famines. The general lack of production and trade made for nearly unimaginable poverty. Average annual per capita gross domestic product (GDP) never exceeded what today would amount to $714.2

This poverty existed within a highly regulated politico-economic system. For most of the Middle Ages, supply and demand—that is, mutual agreement between buyers and sellers, employers and employees, and borrowers and lenders—did not determine prices, wages, or interest rates. Rather, the government (king, queen, or church) dictated “just prices” and “just wages” and for the most part forbade lending money at interest (a practice that the Catholic Church condemned as evil). Industry, such as it existed, was organized under government-authorized trade groups and craft guilds that operated in accordance with strict mandates and excluded competitors by means of charters purchased from the government. Agriculture was based on the compulsory labor of serfs, who were ruled by feudal lords, who were ruled by the crown or church, whose word was the law. Rulers and lords randomly confiscated the wealth of their subjects—often to finance wars by means of which to gain more subjects over which to rule. Private property, recognition of rights, and the rule of law were nonexistent; the rulers could take anything from anyone at any time. Accordingly, workers had no positive incentive to produce beyond what they could immediately consume; no incentive to save money or to make future-oriented investments; no incentive to engage in economic activity, as any surplus production was at substantial risk of being looted. The result was economic stagnation and, for the vast majority of people, subsistence-level existence at best.

The first major legal and political development that would help to change the situation was the signing of the Magna Carta in 1215. Originally known as the “Charter of Liberties,” the Magna Carta was an agreement between King John of England and the baronial nobility, who sought to protect their property from being confiscated by the king.3 The Magna Carta set the precedent that the king is not above the law. It was not immediately or perfectly implemented, but it was a substantial step in the direction of economic freedom, and it implicitly introduced other important legal and political principles as well, including checks and balances, due process, and equality before the law.4 Although the Magna Carta primarily protected the rights of the nobility, it also contained, as Nathan Rosenberg and L. E. Birdzell point out,

a number of provisions guaranteeing rights to merchants (including foreign merchants), and merchants benefited from the property rights it established as part of English law and political tradition. The establishment of the right to hold property free of the risk of arbitrary seizure was important to the expansion of commerce, and Magna Carta gave the English a considerable lead on their neighbors.5

A related change that helped enormously was the establishment of separation of powers between the king, the parliament, and the judiciary. Although initially subservient to the Crown, by the 16th century parliament had achieved the status of an equal partner insofar as royal statutes were considered valid only if parliament approved them.6 The judiciary, on the other hand, had authority over the interpretation and application of common law, which both the king and parliament were expected to uphold and respect. English common law was based on legal precedent, which evolved over time and comprised the aggregate of judicial rulings that had determined the rights of parties in cases brought before the courts. The two major areas with which common law dealt were criminal law and property disputes. Whereas property disputes had once been settled in battle, they were now settled by judges on the basis of the rights of the parties involved.

Although imperfect and inconsistent, the burgeoning recognition and protection of property rights helped foster the growth of trade and commerce because it created an environment in which, to a large degree, individuals could produce, save, and trade goods without fear of their wealth being confiscated.

A number of other factors helped as well. For instance, some towns and cities had largely escaped the control of feudal lords whereas others lay outside the jurisdiction of guilds (which were confined to particular trades and territories).7 Enterprising individuals, seeking to expand their businesses, started trading in such towns. In turn, their need for short-term credit led to greater use of bills of exchange (promissory notes), which, when sold at a discount, circumvented the Church’s prohibition of usury. Tenant farming and trade-based agriculture had begun to replace feudalism and serfdom as peasants were permitted to purchase their freedom from their lords. And the development of the full-rigged ship facilitated the Age of Discovery, which saw an explosion in overseas exploration and trade.8

By the 15th century, the combination of the preceding factors (along with related advancements) gave rise to an autonomous merchant class and an increased volume of relatively unregulated trade. As this trend continued into the 16th century, the Reformation and religious wars further undermined the power of the Church, enabling business increasingly to escape its authority. England even lifted its prohibition on usury; although the government continued to dictate the maximum rate that could be charged, it legalized the lending of money at interest.

But just as independent merchants were largely managing to escape Church, feudal, and guild restrictions, they now had to contend with new restrictions imposed by monarchs. The previous achievements of the English political system had established the protection of property rights via contract enforcement and had limited the extent to which the government could confiscate property. They did not, however, protect against the possibility of property being regulated by the government.

The Tudor dynasty took advantage of this situation and imposed a host of economic restrictions and regulations collectively known as mercantilism, the purpose of which was to increase national wealth by ensuring that more money came into England than went out. This was to be achieved by means of subsidies to promote exports, tariffs and embargoes to discourage imports, and monopoly privileges for favored trading enterprises (such as the East India Company) to further control the market.

Mercantilism, nevertheless, proved to be a self-defeating system. Its policies did not create wealth; they only redistributed it. The favored few enterprises that “benefited” from such policies did so at the expense of their competitors and consumers.9 For example, the Corn Laws, which imposed tariffs on wheat and other grains, caused domestic food prices to be higher than they would otherwise have been. As one historian points out, the impact of mercantilist regulations “was quite predictable: inconveniences, scarcities, high prices, obstacles to enterprise, inflexibility, and great burdens, particularly to the poor.”10 The basic fallacy underlying mercantilism was the equation of wealth with money rather than with goods. The result was that, under its policies, goods became more costly and more difficult to obtain. (Given their acceptance of this fallacy, it should come as no surprise that the mercantilists also resorted to inflation and currency debasement.)

The Stuart dynasty, which succeeded the Tudors, not only continued these statist economic policies, but, invoking the alleged “divine right of kings,” also made several unsuccessful attempts to assert royal authority, to minimize the role of parliament, and to institute absolute monarchy. Political resistance to the Stuarts, however, led to the Glorious Revolution of 1688, in which the Parliamentarians decisively defeated the Stuart push for royal absolutism. Parliament’s subsequent passage of the English Bill of Rights in 1689 officially established a constitutionally limited monarchy.

In his seminal book Two Treatises of Government (1690), John Locke provided an intellectual sanction of the Glorious Revolution and an explicit (albeit imperfect) philosophical justification for individual rights. The individual, Locke argued, has a right to his own life and, by extension, to his property; and the proper purpose of government is to protect individual rights: “The great and chief end, therefore, of men uniting into commonwealths, and putting themselves under government, is the preservation of their . . . lives, liberties, and estates, which I call by the general name—property.”11 Locke’s ideas, including his advocacy of a limited, rights-respecting government, dominated political discussion in 18th-century Britain.

Scottish economist Adam Smith followed with an economic argument for freedom and limited government. In his magnum opus The Wealth of Nations (1776), Smith argued that the whole edifice of mercantilism—including its controls, protectionism, and other burdensome regulations—stifled competition and productivity, thereby hampering the creation of wealth. Free trade and free markets, Smith explained, maximize wealth creation and result in “universal opulence which extends itself to the lowest ranks of the people.”12

Also in 1776, across the Atlantic, American Revolutionaries had officially broken from Britain on the principled grounds that when a government ceases to protect rights and instead “becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government.”13

The ideas of Locke, Smith, and the Revolutionaries dramatically influenced British culture and politics. By the late 18th century and continuing into the 19th century, these and related ideas had pushed the British government to repeal or stop enforcing numerous interventions, including guild restrictions on the mobility of labor and capital; government-sanctioned trade monopolies such as that granted to the East India Company; prohibitions such as the Bubble Act, which outlawed the formation of joint-stock companies; embargoes on imports; laws authorizing the fixing of prices and wages; and various laws and regulations that had previously dictated major and minor aspects of commerce, from tariffs on grains (the Corn Laws) to laws specifying the permissible weight and dimensions of woolen and linen cloth.14 Economic historian Phyllis Deane summarizes that “between 1760 and 1850 a mass of governmental rules and restrictions on economic activity, many of them dating from medieval times, were swept out of the statute book.”15 In addition to freeing up legitimate markets, Britain outlawed the one illegitimate market, slavery, by banning the slave trade in 1807 and abolishing slavery altogether in 1833.

The net effect of these sweeping changes was that Britain had achieved a politico-economic system close to genuine capitalism (the system in which government is strictly limited to the protection of individual rights).16 Although Britain had not achieved full recognition and protection of rights, with the notable exception of 19th-century America, it had come as close to that ideal as any nation had ever come.

What effects did this near-capitalist system have on the citizens of Britain?

Confident that they would be able to keep the products of their efforts, private entrepreneurs in the late decades of the 18th century—the beginning of the Industrial Revolution—started launching the large-scale industrial enterprises that would soon transform the British economy on an unprecedented scale. The transformation would consist of numerous interconnected developments, including the privatization of common lands; the development of an integrated transportation system; and countless new inventions, including many labor-saving machines. The net effect would be more and better goods, lower prices, and increased real wages—in short, a higher standard of living. Toward a concrete understanding of the causal connections involved, let us consider these developments more closely.

Prior to the 18th century, most agricultural land in Britain consisted of common areas and collectively farmed fields. These conditions led to the phenomenon known as the “tragedy of the commons”: When property is owned by the community or “commons,” users of that property have relatively little incentive to improve or maintain it because others can use or abuse any improvements one might make and because one who makes an improvement will not reap all the benefits of having done so. As an expression of Britain’s growing recognition of property rights, however, Parliament passed numerous Enclosure Acts authorizing the systematic privatization and consolidation of common lands and open-field farms into individually owned farms.17

Whereas in 1700 half of all open land in England was collectively “owned,” by 1830 virtually all of it had been privatized.18 Individual farmers now truly owned their farms; thus they were free to improve the land without fear that others would trample their improvements, free to cultivate the land as they thought most fruitful, and free to reap the full reward for maintaining and improving their farms. Whereas prior to this privatization farmers had engaged in subsistence agriculture, they now strove to produce agriculture for the market—for profit. The result? The quantity and quality of agriculture exploded, and (local) famines and acute food shortages due to bad harvests became a problem of the past.19

Enclosure increased competition, innovation, and investment. Farmers adopted more efficient techniques such as selective animal breeding, convertible husbandry (the rotation of grass lands with arable lands, which restored the nitrogen content and thus the fertility of the soil), and the Norfolk four-course crop rotation (a more sophisticated form of convertible husbandry in which clover and turnips were rotated with wheat and barley). The increased demand for agricultural tools that would increase efficiency and output spurred inventors to develop new and improved machines, such as Joseph Foljambe’s Rotherham plough (1730), Jethro Tull’s seed drill (1731), and Andrew Meikle’s threshing machine (1784). Ownership of their land spurred farmers to invest in hedging, ditching, and drainage.20 The result was a dramatic increase in agricultural productivity with a dramatic decrease in the percentage of people working in agriculture.21 From 1700 to 1850, agricultural output increased by an estimated 172 percent22—while the percentage of the population engaged in agriculture dropped from approximately 55 percent to 22 percent.23 This further fueled the economy, as less labor needed in agriculture meant more labor was available for other industries.

Coinciding with the shift toward profit-driven agriculture was the development of an extensive transportation network. Most people today assume that the government must provide “infrastructure”—especially roads—for an economy to function. But in Britain, private entrepreneurs financed and built not only most roads, but also most canals and railroads.24 The construction of roads, canals, and railways requires large amounts of capital. Where did this capital come from? It came from the substantial savings that were accumulating as a result of the growth in agricultural productivity. Farmers were earning higher incomes and saving more money. Many of them, along with other businessmen and merchants, invested their savings in local roads, canals, and railways because they stood to benefit directly from better and cheaper transport, which would expand the market for their goods.25

Prior to the 18th century, government played a considerable role in building English roads—which were then among the worst in Europe. Throughout the 18th century, however, numerous Turnpike Acts turned the building and maintenance of roads over to private enterprise, which proceeded to improve the quality of existing roads and to construct a vast network of new roads linking most towns in England.26 Businessmen built roads where they needed them for commerce and where they thought there would be enough traffic to make money collecting tolls.27 As new roads connected local markets, production and the volume of trade increased. Consequently, a national market emerged for many products that previously were limited to local or regional markets.

Transport links also expanded with the building of canals, which, from the 1760s to the 1820s, were the predominant transport routes for heavy freight. Canals linked the major industrial areas, connecting every navigable waterway to every other.28 This considerably reduced the cost of transporting agricultural commodities, farm inputs (such as lime and manure),29 machinery, and coal. For example, Francis Egerton, the Duke of Bridgewater,30 commissioned and financed the construction of a canal from his coal mines in Worsley into Manchester. Completed in 1761 and later extended to other towns, the Bridgewater Canal cut the cost of transporting coal between Worsley and Manchester by half compared to the previous cost of transporting coal via road.31

Then came railroads. In 1830, the opening of the Liverpool-Manchester route marked the beginning of the railroad age. From this time to the 1850s, approximately six thousand miles of railway were laid in Britain.32 Due to the enormous capital requirements of the railroads, the businessmen who owned them sold securities to the general public in order to obtain financing. This large speculative investment, nevertheless, brought great benefits: The railroads reduced the cost of transport even beyond the remarkable reductions in cost achieved by the canals—while also dramatically increasing the speed of transportation. Travel times that had previously been measured in weeks or days were now measured in hours.

The system of roads, canals, and railways expanded markets, reduced costs, facilitated greater communication, enabled greater specialization and division of labor, spawned greater mobility of labor and capital, integrated the British economy, and spurred interregional trade. In short, this vast transportation system enabled the hyperdevelopment of industry.

The huge and expanding market for goods created greater and greater incentive for innovators to innovate. If someone invented a new device or product that people would like, or developed a new process that could enhance production, he could now sell it far and wide rather than just locally. Furthermore, the growth of savings provided the necessary capital to invest in such innovations. Accordingly, new inventions sprang up everywhere, as indicated by the number of new patents. Prior to the 1750s, the number of new patents in any given decade rarely exceeded 100, but in the 1760s it jumped to 205, in the 1790s to 647, in the 1820s to 1453, and in the 1850s to 4581.33

Arguably, the most important invention of the Industrial Revolution was the coal-powered steam engine, which dramatically increased productivity across most sectors of the economy, from mining to metallurgy to manufacturing to transportation. And, like most inventions, it not only solved problems but also gave rise to new ones and thus to new opportunities for invention and further progress. For instance, the use of the coal-powered steam engine on such a broad scale required huge amounts of coal. Serendipitously, the steam engine also made possible the mining of huge amounts of coal. One problem that limited coal production was the seepage of water into mines, which could bring production to a halt. But in 1705, Thomas Newcomen invented the atmospheric steam engine, which enabled miners to pump out the water, thereby permitting uninterrupted mining and deeper working of mines. With this new engine (and countless other inventions and improvements), coal production increased fivefold between 1700 and 1800.34

Newcomen’s engine, however, had a limited use beyond the mines because it consumed large amounts of coal itself. So, in the 1760s, James Watt improved the Newcomen engine by adding a separate condenser—and then proceeded to develop a rotary motion steam engine (1781), which reduced the machine’s coal consumption by two-thirds.35 Because of its greater efficiency, engineers were able to use the Watt engine to develop steam-powered machinery, which in turn made possible production orders of magnitude greater than in the past. Textile production, for instance, significantly increased as a result of steam-powered machinery in conjunction with other inventions that mechanized the spinning of cotton into yarn and the weaving of yarn into cloth. These inventions included James Hargreaves’ spinning jenny (1768), Richard Arkwright’s water frame (1769), Samuel Crompton’s mule (1779, a cross between the jenny and water frame), and Edmund Cartwright’s power loom (1787). Such machines multiplied rapidly. The number of power looms, for example, increased from 14,000 in 1820 to about 100,000 by 1833.36

Prior to industrialization, converting one hundred pounds of raw cotton to thread took 50,000 hours, as it had to be done by hand. By the early 19th century, it took only 300 hours, thanks to machinery.37 As a result of this advancement, between 1786 and 1807 the price of cotton yarn plummeted by more than 80 percent38—even as Britain’s demand for cotton skyrocketed. (Much of Britain’s imported cotton came from America, whose cotton production grew considerably due to another invention of the Industrial Revolution, Eli Whitney’s cotton gin [1793].)

Coal, new machinery, and related processes advanced productivity in the iron and steel industries as well. For instance, the development of coal-powered blast furnaces along with Henry Cort’s invention of a process called puddling and rolling (1784), which efficiently converted pig iron into wrought iron, increased the annual production of pig iron from 30,000 tons in 1770 to 2 million tons by 1850.39 In 1856, Henry Bessemer introduced the Bessemer process, which was the first inexpensive method for mass-producing steel. As a result of this invention, steel production soared from 49,000 tons annually in 1850 to 1.44 million tons by 1880.40

With dramatically increased output and reduced prices, iron and steel replaced wood as the basic materials of choice for most durable capital goods. The widespread availability of these metals allowed for more precise construction and mechanical complexity in tools, buildings, bridges, and boats; and it enabled the mass production of goods such as pipes, engines, industrial machinery, steamships, and railroads.

The foregoing barely touches on the numerous innovations and products achieved during the British Industrial Revolution. But even in this brief survey of the era we can see an important truth about it: The growth and development of each industry redounded on other industries, which redounded on still more, and so on. Innovations in one industry led to advances in others. Investments in one led to opportunities in others. Increased supply in one led to increased demand in others. For example, Newcomen’s invention of the atmospheric steam engine increased the supply of coal. Entrepreneurs built more canals (primarily) to transport coal, which significantly reduced its price (and the price of other raw materials as well). Watt’s invention of the rotary motion steam engine and its adoption across multiple industries led to an increased demand for coal—the fuel source for the steam engine. Watt’s coal-powered steam engine also increased the supply of goods such as textiles and iron. Businessmen then used low-cost iron as a basic material across numerous industries, including using it to make more efficient and durable steam engines. The growth of the railroad industry, fueled by the steam engine, significantly increased the demand for iron, steel, and coal. Railroads, in turn, further reduced transport costs, increased transport speed, and connected practically every market to every other. The net result of such integrated, mutually beneficial developments was an unprecedented and sustained increase in economic growth.

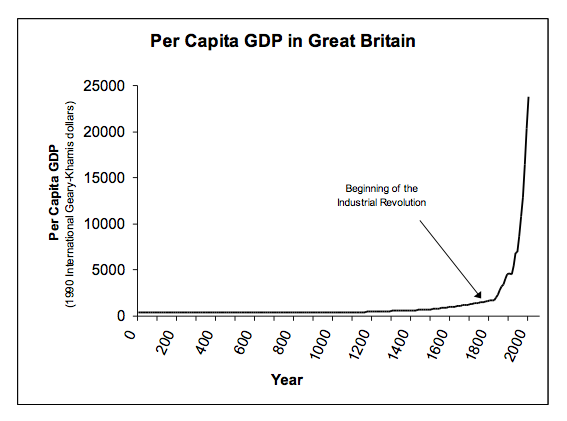

Now observe the relationship between the unprecedented economic growth of this era, the population growth at the time, and per capita income in the same period. Prior to the Industrial Revolution, population growth typically led to declining per capita income because the increase in people meant an increase in demand for a relatively stagnant quantity of goods, causing prices to rise.41 But from 1750 to 1850, while the population in England increased from 5.8 million to 15.9 million,42 instead of stagnating or declining, per capita income steadily rose.43 Why?

Per Capita GDP in Great Britain

Capital accumulation and technological advances increased productivity, which in turn increased the quantity of goods produced. The supply of money, however, increased at a relatively slow rate (as the predominant form of money was gold). What happens when rapid growth in the supply of goods meets with slow or moderate growth in the supply of money? Prices drop so that products will sell.

From 1821 to 1914, average prices in Britain decreased at an average annual rate of 0.4 percent.44 This translated to an increase in real wages, as cheaper goods enabled workers to buy more (or save more). According to one estimate, between 1819 and 1851, real wages doubled.45

Finally, observe what made all of this possible. The British Industrial Revolution demonstrated the great potential of man. But human nature does not change over time, so what made the difference? Why was this era so astoundingly productive whereas other eras have paled by comparison? The answer, in a word, is freedom. Individuals during this time were essentially free to act on their own judgment for their own sake. Government did not attempt to plan or direct the complex interconnected market developments of the British Industrial Revolution. These developments were planned and directed by countless inventors, innovators, laborers, and profit-seeking entrepreneurs pursuing their own interests in a substantially free, substantially rights-respecting politico-economic system.

Those who try to imagine what men could accomplish if the government refrained entirely from intervening in the economy need not imagine too hard. In the 19th century, Britain came reasonably close to eliminating government interference in the market—and the result was the amazing achievements of the Industrial Revolution.

You might also like

Endnotes

Acknowledgments: I would like to thank Craig Biddle, Ben Bayer, and Alan Germani for their helpful comments, suggestions, and edits on this article.

1 Eric Hobsbawm, Industry and Empire: The Birth of the Industrial Revolution (New York: The New Press, 1999), p. xx.

[groups_can capability="access_html"]

2 Angus Maddison, Statistics on World Population, GDP and Per Capita GDP, 1-2006 AD, http://www.ggdc.net/maddison/Historical_Statistics/horizontal-file_02-2010.xls. In order to measure GDP for the distant past, economists cannot use the same methodology that they use for measuring current GDP, because that kind of data is not available. Rather, they make inferences, estimates, and educated guesses based on whatever facts are available for the time and place in question.

3 Brian Tamanaha, On the Rule of Law: History, Politics, Theory (Cambridge: Cambridge University Press, 2004), p. 25. Pope Innocent III forbade King John to obey the Magna Carta, claiming that it was invalid and derogatory. John subsequently repudiated the agreement, but King Henry reaffirmed a new charter in 1225.

4 William J. Bernstein, The Birth of Plenty: How the Prosperity of the Modern World Was Created (New York: McGraw-Hill, 2004), pp. 69–73; Bernard H. Siegan, Property Rights: From the Magna Carta to the Fourteenth Amendment (New Brunswick: Transaction Publishers, 2001), pp. 7–9.

5 Nathan Rosenberg and L. E. Birdzell, Jr., How the West Grew Rich: The Economic Transformation of the Industrial World (New York: Basic Books, 1986), p. 119.

6 Richard Pipes, Property and Freedom (New York: Vintage Books, 2000), pp. 122, 129.

7 Rosenberg and Birdzell, How the West Grew Rich, p. 90.

8 Rosenberg and Birdzell, How the West Grew Rich, pp. 24–25, 55–56, 66, 81, 84, 117, 132.

9 Murray Rothbard, “Mercantilism: A Lesson for Our Times?” in The Industrial Revolution and Free Trade, edited by Burton W. Folsom Jr. (New York: The Foundation for Economic Education, Inc., 1996), pp. 7–10.

10 Clarence B. Carson, “The Rise and Fall of England: 2. Pre-industrial England,” The Freeman, vol. 18, no. 4, April 1968, p. 226.

11 John Locke, The Second Treatise on Civil Government (New York: Prometheus Books, 1986), p. 70.

12 Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (New York: Modern Library, 1965), p. 11.

13 “The Declaration of Independence,” July 4, 1776, http://www.ushistory.org/declaration/document/index.htm.

14 Phyllis Deane, The First Industrial Revolution, 2nd ed. (Cambridge: Cambridge University Press, 1979), pp. 220–21, 225.

15 Deane, First Industrial Revolution, p. 220.

16 Ayn Rand, Capitalism: The Unknown Ideal (New York: Signet, 1967), p. 19.

17 There has been much criticism of the enclosure movement, but as Bernstein (Birth of Plenty, pp. 213–14) points out, “although a minority of farmers were unjustly driven off their land, most historians now agree that the English concern for property rights and due process were, for the most part, observed, and that the process was on the whole fair and just. The number of small landowners increased significantly as the enclosure acts conferred ownership upon those whose families had tended the small common strips over the generations.”

18 Bernstein, Birth of Plenty, p. 213.

19 Mark Overton, Agricultural Revolution in England: The Transformation of the Agrarian Economy 1500–1850 (Cambridge: Cambridge University Press, 1996), pp. 140–41.

20 Deane, First Industrial Revolution,pp. 39, 166.

21 Robert C. Allen, The British Industrial Revolution in Global Perspective (Cambridge: Cambridge University Press, 2009), p. 65; Overton, Agricultural Revolution in England,pp. 164–67.

22 Overton, Agricultural Revolution in England,pp. 75, 86.

23 Overton, Agricultural Revolution in England,p. 82.

24 David S. Landes, The Wealth and Poverty of Nations: Why Some Are So Rich and Some So Poor (New York: W. W. Norton & Company, Inc., 1999), pp. 264–65.

25 T. S. Ashton, The Industrial Revolution 1760–1830 (London: Oxford University Press, 1948), p. 57; Deane, First Industrial Revolution,p. 173.

26 Deane, First Industrial Revolution,pp. 73–74.

27 Rick Szostak, The Role of Transportation in the Industrial Revolution: A Comparison of England and France (Montreal: McGill-Queen’s University Press, 1991), pp. 60–61.

28 Szostak, Role of Transportation in the Industrial Revolution, pp. 56, 58–59.

29 Overton, Agricultural Revolution in England,p. 142.

30 Some of the large landed proprietors, it should be pointed out, were not genuine self-made capitalists. They inherited their estates, titles, and privileged status from the peerage system that dated back to medieval feudalism. By the 18th century, however, many of the large landowners were successful merchants who had bought country estates.

31 Ashton, Industrial Revolution 1760–1830,p. 58.

32 Hobsbawm, Industry and Empire, p. 88.

33 Deane, First Industrial Revolution,p. 136.

34 Allen, British Industrial Revolution in Global Perspective, p. 82.

35 Rosenberg and Birdzell, How the West Grew Rich, p. 155.

36 Ashton, Industrial Revolution 1760–1830,p. 53.

37 Jeremy Atack, “Long-Term Trends in Productivity,” in The State of Humanity, edited by Julian Simon (Oxford: Blackwell Publishers Ltd., 1995), p. 164.

38 Deane, First Industrial Revolution,p. 92.

39 R. M. Hartwell, The Industrial Revolution and Economic Growth (London: Methuen & Co., 1971), pp. 121–22.

40 Hobsbawm, Industry and Empire,p. 94.

41 Gregory Clark, A Farewell to Alms: A Brief Economic History of the World (Princeton: Princeton University Press, 2007), pp. 24, 26, 193; C. Knick Harley, “Reassessing the Industrial Revolution: A Macro View,” in The British Industrial Revolution: An Economic Perspective, edited by Joel Mokyr (Boulder: Westview Press, 1999), pp. 160–61; Deane, First Industrial Revolution,p. 35.

42 Joel Mokyr, The Enlightened Economy: An Economic History of Britain 1700–1850 (New Haven: Yale University Press, 2009), p. 281.

43 Clark, Farewell to Alms,p. 193.

44 Richard M. Salsman, Gold and Liberty (Great Barrington: American Institute for Economic Research, 1995), p. 46.

45 Peter H. Lindert and Jeffrey G. Williamson, “English Workers’ Living Standards During the Industrial Revolution: A New Look,” The Economic History Review, vol. 36, no. 1, February 1983, pp. 1–25. Real wages are measured in terms of the quantity of goods that can be purchased whereas nominal wages are measured in terms of money. For example, if one’s nominal wage remains unchanged but the price of goods increases, then one’s real wage will have declined because one’s nominal wage will no longer be able to purchase as many goods.

[/groups_can]

![[TEST] The Objective Standard](https://test.theobjectivestandard.com/wp-content/uploads/2017/10/logo.png)